Last Updated on September 29, 2025 by Andrew Shih

Are you self-employed, a freelancer, or a side hustler? If so, you understand the unique challenges and demands of managing your finances while juggling the responsibilities of running your own business.

You probably wonder if there is a banking app that can help you keep track of expenses, do bookkeeping, and manage your taxes.

In this Found review, we will introduce this online banking app designed for the self-employed, freelancers, and side hustlers. We will compare Found with traditional banks and discuss the key features, pricing plan, and pros and cons to help you determine if Found is right for you.

Disclaimer: Wisdom Depot is affiliated with Found.com. Please review the full affiliate disclaimer.

What is Found Banking?

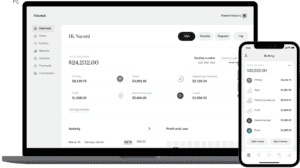

Founded in 2019, Found is a fintech company revolutionizing banking for self-employed individuals. Found simplifies financial management by integrating banking, tax management, bookkeeping, and invoicing into a user-friendly platform.

Found introduced Found Plus in 2023, enhancing its offerings with high-yield savings, dedicated customer support, and advanced bookkeeping features.

Found has earned a Trustpilot rating of 4.4/5, showcasing its commitment to providing exceptional service and support to freelancers, independent contractors, and small business owners.

Accounts at Found are held by their partner bank Lead Bank, Member FDIC, and these accounts are FDIC insured up to $250,000 per depositor for each account ownership category..

Found Banking differs from traditional business banking models in several key aspects. Firstly, it operates entirely online, eliminating the need for physical branches and offering a more efficient and accessible banking experience.

Found Banking provides modern technology and user-friendly mobile apps, enabling clients to manage their finances, bookkeeping, expenses, tax, and invoices seamlessly from anywhere.

Moreover, Found Banking offers better perks and higher interest rates for savings accounts due to its lower overhead costs.

Additionally, Found Banking maintains a transparent fee structure, avoiding hidden fees commonly found in traditional banks.

Overall, Found Banking prioritizes simplicity, efficiency, and innovation to cater to the unique needs of self-employed individuals.

Key Features of Found Banking

Banking

Found Banking offers a range of features tailored to the self-employed:

- No Required Monthly Fees*: Say goodbye to surprise charges with Found Banking’s transparent fee structure.

- Easy Sign-Up: Joining Found Banking is hassle-free, with no mandatory monthly fees or minimum balance requirements.

- Seamless Integration: Connect your favorite apps like Quickbooks and Stripe effortlessly.

- Mobile Check Deposit: Deposit checks conveniently using your smartphone.

- Mastercard® Business Debit Card: Manage your expenses on the go with a dedicated business debit card.

- Unlimited Transactions: Conduct your business without worrying about transaction limits.

- FDIC Insured: Up to $250,000 per depositor through Found’s partner bank Lead Bank.

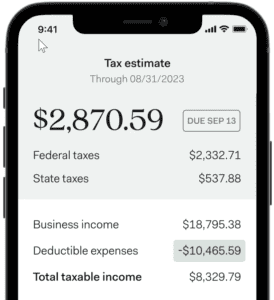

Tax Management

Found Banking simplifies tax management with features like:

- Auto-Save for Taxes: Set aside money for taxes automatically with every payment.

- Real-Time Tax Estimates: Stay informed about your tax obligations with up-to-date estimates.

- Write-Off Tracking: Maximize your deductions by keeping track of eligible expenses.

- In-App Tax Payments: Pay your taxes directly from the app (as a Schedule C filer), eliminating paperwork and hassle.

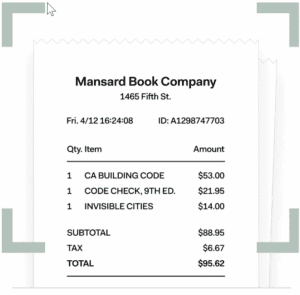

Bookkeeping

Managing your finances is effortless with Found’s bookkeeping tools:

- Automatic Expense Tracking: Categorize expenses and save receipts effortlessly.

- Powerful Reporting: Gain insights into your business finances with customizable reports.

- Receipt Capture: Say goodbye to paper clutter with built-in receipt capture functionality.

- Real-Time Reporting: Keep tabs on your business’s performance with real-time reports accessible from anywhere.

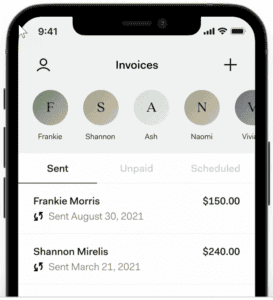

Invoicing

Get paid easily with Found’s invoicing feature:

- Professional Invoices: Create customized invoices with your branding in minutes.

- Multiple Payment Options: Accept payments conveniently via bank transfers, credit cards, and more.

- Automatic Payment Reminders: Stay on top of outstanding invoices with automated reminders.

- Seamless Workflow: Manage your income effortlessly with integrated invoicing tools.

Found Banking Pricing Plans

Found Banking offers two pricing plans to cater to different needs. Here is the feature comparisons between the two plans.

FEATURES | FOUND | FOUND PLUS |

BANKING | ||

Business debit MasterCard® | ||

No minimum balance | ||

Unlimited transactions | ||

Get paid 2 days early with direct deposit (early availability not guaranteed) | ||

Multiple virtual cards with custom limits | ||

1.5% APY on balances up to $20K | ||

BOOKKEEPING | ||

Automated expense tracking | ||

Receipt capture | ||

Custom rules, categories, and tags | ||

One-click business reports | ||

Unlimited custom invoices | ||

Manage 1099 contractor payments | ||

Accountant access | ||

Auto-import expense from receipt | ||

Import activity from your bank, credit card, Venmo, and PayPal accounts. | ||

TAXES | ||

Auto-saving for taxes | ||

Auto-generated tax forms | ||

Real-time tax estimate | ||

Write-off tracking | ||

In-app quarterly federal tax payments for all Schedule C filers | ||

Free tax filing through Column Tax with Found Plus annual | ||

SUPPORT | ||

Expert customer support | ||

Priority customer support | ||

PRICE | ||

PRICE | FREE | $19.99/Month or $149.99/Year 30-Day Free Trial |

The free Found plan offers plenty of features for self-employed individuals with many essential tools for banking, expense tracking, bookkeeping, and tax-saving. With the premium plan, you get additional benefits that you may find desirable. such as:

- 30-Day Free Trial: You can try premium features for free within 30 days.

- Banking: Found Plus users can earn 1.5% APY on balances up to $20,000. That’s $300 in interest, which is more than enough to pay the annual fee for the premium plan.

- Bookkeeping: The ability to auto-import expenses from receipts and activities from multiple sources can be a huge time and money saver.

- Taxes: The ability to keep track and pay taxes timely can help avoid last-minute surprises and penalties.

- Support: Priority customer support.

Pros of Found Banking

No Required Monthly Fees*

No one enjoys paying fees. With Found Banking, you can enjoy transparent pricing with no required monthly fees, no overdraft fees, free incoming domestic wires, and no minimum opening deposit. This transparent fee structure allows them to manage their finances confidently without worrying about unexpected charges eating into their profits.

Comprehensive Services

Self-employed individuals wear many hats, from managing their business finances to handling tax obligations and invoicing clients. Found Banking addresses these challenges by offering integrated banking, bookkeeping, tax assistance, and invoicing tools. By consolidating these services into one platform, Found Banking simplifies financial management for freelancers, allowing them to focus more on growing their business.

Seamless Integration

Found Banking recognizes the need to streamline business operations and seamlessly integrates with popular business apps such as PayPal, Stripe, and Etsy. This integration enhances functionality and efficiency, enabling freelancers and self-employed to manage their finances more effectively and save valuable time.

Early Direct Deposit

Cash flow is crucial for self-employed individuals, especially when waiting for payments from clients. Found Banking offers early direct deposit, allowing freelancers to access their funds up to two days early.* This feature provides financial flexibility and peace of mind, ensuring that self-employed individuals have timely access to their earnings to cover expenses and invest in their businesses.

Expert Customer Support

Expert customer support from a dedicated team adds another layer of reassurance for self-employed individuals banking with Found Banking. Whether it is assistance with account setup, troubleshooting technical issues, or answering questions about financial tools, clients can rely on knowledgeable support staff to provide prompt and personalized assistance.

Cons of Found Banking

Limited Customer Service Hours

Phone support is available only during business hours. For a self-employed who works 24/7 or side hustlers who work during off hours, it can be inconvenient without in-person support.

Account Setup Restrictions

Initial account setup requires personal information, with business details added later. While this design seems ideal for sole proprietor, it’s less desirable for clients with other business entities that has EIN.

Cash Deposit Limitations

Cash deposits are subject to limits and associated fees. Since Found does not have a physical store, it rely on 79,000+ retails stores national-wide to accept cash deposits. You will need to pay $2 per deposit. You can only depot up to $2,000 within 7 days, and $4,000 within rolling 30-days.

Online-Only Service

Lack of physical branches may be inconvenient for some users. While you will be able to get most of the tasks done online or from a mobile device, it can be inconvenient without a physical store, such as making a cash deposit or resolving issues.

Conclusion: Is Found Banking Right for You?

If you are self-employed, a freelancer, or a side hustler looking to have a business checking account with free tax-saving, expense tracking, bookkeeping, and invoicing tools, Found can be a great option to get started for free and take advantage of these time and money-saving tools.

However, if you handle cash as part of your business, have a balance beyond $20k, or your business has already outgrown these caps, one option is to open an account with Found to utilize those business tools while keeping your cash deposit with a traditional bank without those caps and offers a higher yield.

Overall, Found online banking complements traditional banks that you can optimized based on your banking needs and the banks’ pros and cons.

Found Review

Summary

Found is a good option for self-employed, freelancers, or side hustlers who are looking for online banking with free/affordable expense tracking, bookkeeping, tax-saving, and invoicing capabilities that traditional banks do not offer.

However, the lack of 24/7 support, physical branches, as well as fees and caps on cash deposits, result in a lower score for banking features compared to traditional banks.

Overall, Found online banking may serve as a great complement to the traditional banks.

Found is a financial technology company, not a bank. Business banking services are provided by Lead Bank, Member FDIC. The funds in your account are FDIC-insured up to $250,000 per depositor for each account ownership category. The Found Mastercard Business debit card is issued by Lead Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted.

*Found’s core features are free. Found also offers an optional paid product, Found Plus for $19.99/month or $149.99/year.